You’re a small business owner, and you know every penny counts. But are you leveraging tax planning strategies effectively? If you’re not, you’re likely leaving money on the table.

This guide will break down key deductions, the importance of record keeping, and strategic ways to minimize your tax liability.

Plus, we’ll show how choosing the right business entity and enlisting small business tax services can make all the difference.

Understanding the Importance of Tax Planning for Small Businesses

You’ve got to understand the importance of tax planning for your small business’s financial health. It’s not just about filling out forms and meeting deadlines. It’s a strategic move that can substantially lower your tax liability, thereby increasing your profits.

Firstly, tax planning helps identify the most efficient way to handle income and expenses. By leveraging tax deductions and credits, you’ll see a significant reduction in your tax bill.

Secondly, proactive tax planning allows you to predict your tax expenses accurately. No more unexpected tax bills that can disrupt your cash flow.

Lastly, it protects your business from non-compliance penalties. Laws change, and staying updated ensures you’re not caught off-guard.

In essence, tax planning isn’t a luxury—it’s a necessity. It’s about financial stability and making informed decisions.

Key Tax Deductions Available to Small Businesses

There are at least ten key tax deductions you can use for your small business. These deductions include operating expenses, employee benefit programs, and business travel, to name a few.

You can deduct all operational costs, from office rent to advertising fees. Employee benefits like healthcare premiums and retirement planning also offer tax advantages. Don’t forget about business travel expenses, which can be deducted too.

If you’re using vehicles for work, you’re eligible to claim fuel, repairs, and even depreciation. Accelerated depreciation methods and R&D expenses can provide substantial tax breaks.

If you’ve got uncollected invoices, those bad debts are deductible. So are education and training costs. Finally, structuring executive compensation efficiently can lead to significant tax savings.

It’s crucial to plan strategically to maximize these deductions.

The Necessity of Accurate Record Keeping in Tax Planning

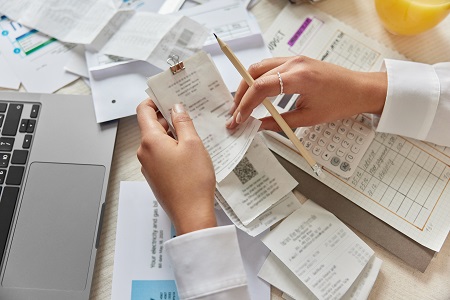

Every single receipt you’ve stashed away plays a vital role in your tax planning, and without precise record keeping, you’re risking potential drawbacks. Neglecting this task can lead to missed deductions, overpayment, and potential audits.

It’s essential to track all business expenses, from minute to substantial. Your tax service can help by creating a streamlined process, ensuring no detail slips through the cracks. They’ll categorize receipts, reconcile bank statements, and monitor your cash flow meticulously.

Don’t underestimate the power of a well-maintained ledger. It’s not just about avoiding penalties; it’s about claiming every allowable deduction, optimizing your tax liability, and, ultimately, strengthening your financial standing. So, keep those receipts and records organized, and let your tax service guide you through efficient tax planning.

Strategic Ways to Maximize Deductions and Minimize Tax Liability

In your pursuit of maximizing deductions and minimizing tax liability, it’s crucial to consider both income-shifting strategies and tax credit utilization.

Income shifting involves legally transferring income within a family to take advantage of lower tax brackets. You’re essentially redistributing the tax burden.

Tax credits, on the other hand, directly reduce your tax bill. You should understand that these aren’t mere deductions—they’re dollar-for-dollar reductions in what you owe. It’s astute to explore credits such as the Work Opportunity Tax Credit or the Disabled Access Credit.

Leveraging tax services can optimize these strategies. Their deep understanding of tax codes can pinpoint exactly what’s relevant to you and your business. So, you’re not just saving money—you’re making the most of your financial decisions.

Leveraging Tax Credits

Undoubtedly, you’re making a smart move when leveraging tax credits to reduce your business’s overall tax liability. This strategy isn’t just about saving money. It’s about optimizing your financial management and ensuring that every dollar is working hard for your business.

Research and Development Tax Credit: If you’re investing in innovation, your efforts could qualify for R&D credits.

Work Opportunity Tax Credit: Hiring from certain groups such as veterans or the long-term unemployed? There’s a tax credit for that.

Energy-Efficient Improvement Credit: If you’re making eco-friendly upgrades, you might be eligible for this credit.

It’s clear that an effective tax strategy is multi-layered and requires a detailed understanding of the tax code. That’s where a seasoned tax service comes in – to help you navigate the complexities and ensure you’re leveraging every available credit.

Choosing the Right Business Entity Structure

You’ve got three main options when picking a business entity structure, but it’s vital to remember that each one has its own tax implications and legal requirements.

It’s a choice between a sole proprietorship, a partnership, or a corporation. As a sole proprietor, you’re the business. This simplicity comes with unlimited personal liability.

Partnerships, on the other hand, share that liability among two or more individuals. However, it still leaves personal assets exposed.

Corporations protect personal assets but have double taxation – once on corporate profits, then on dividends.

A tax service with extensive experience can help you weigh these options, analyze your business situation, and choose the most beneficial structure for your tax planning strategy.

Don’t underestimate the importance of this decision; it’ll significantly impact your business’s financial health.

The Role of Tax Services in Strategic Tax Planning

Through the lens of strategic tax planning, a tax service offers more than just tax savings. They provide expertise that can help with informed decision-making and better financial management.

A proficient tax service can illuminate the path to potential tax savings and strategic decisions. They can guide you in timing and shifting income and expenses to optimize tax outcomes. Additionally, they can ensure you’re maximizing business tax deductions and credits, including often overlooked ones such as R&D expenses and energy-efficient investments.

Furthermore, a tax service can assist in optimizing your business entity structure for tax efficiency. Their knowledge of complex tax laws and up-to-date information on tax changes can help you navigate the maze of business taxation, thereby reducing your tax liability while ensuring compliance.

LBS Tax Services Helps Businesses Strategize Their Taxes

In the realm of tax strategy, you’re not only minimizing your tax liabilities with LBS Tax Services but also enhancing your overall business performance and profitability. Our comprehensive services, which include tax consulting, tax returns, and start-up services, allow you to focus on effective decision-making. We will lift the weight of business accounting and taxation off your shoulders, providing a clear path to success.

LBS is committed to helping you maximize deductions and minimize tax liability. Our expertise in services for business owners, including charitable donations, business tax returns, and equipment deductions, ensures that you’re saving on your taxes. Plus, our guarantee to correct any errors and reimburse for penalties or interest damages offers you peace of mind.

With LBS Tax Services, you’re not just strategizing your taxes; you’re bolstering your business’s future.

Some of our strategies:

- Bookkeeping Services

- Delicate Cash Flow Balances

- Business Tax Preparations

- Payroll Solutions

- Business Accounting Services

Contact us today for exceptional customer service from our diversified team.

Visit our About Us for more information about our tax consultant firm.