With the coronavirus pandemic on foot and still around, it’s tempting to put off filing your return. Especially with the new deadline of July 15th from April 15th, you may think there’s time to kill.

We understand that most taxpayers dread the task of compiling their financial records, tax documents and filing their taxes. Unfortunately, the longer you procrastinate with doing your taxes, the greater the chances that something will go wrong becomes.

If you owe money to the IRS? Well, the more penalties and interest you’ll have to pay. Often, it’s a better idea to file your taxes sooner rather than later.

Why? Well, let us explain.

IDENTITY THEFT WITH TAXES

Tax return fraud is one of the most common and fastest growing forms of identity theft. Basically, an identity theft occurs when a thief steals your employment information and Social Security number – and files a fraudulent tax return on your behalf. With this information, they steal your refund, or even worse, put you in a hole owing back taxes you might not actually owe.

Unfortunately, once the IRS sends your tax refund out, it’s nearly impossible to get the money back without knowing the law and regulations. One way to avoid falling victim to tax fraud is to file your taxes as early as possible. That way, you reduce the chances of tax identity theft by filing before the identity thief gets a chance to file a fraudulent return for you.

FIND AND CORRECT MISTAKES SOONER

Filing your tax return earlier makes it easier to fix any mistakes on your tax documents. For example, your employer might record the wrong earnings on your W-2. If you discover a mistake on your tax documents right before the filing deadline, you aren’t going to have enough time to get the mistake resolved. Your tax return will end up getting delayed, and you will have to go through the process of requesting an extension from the IRS, tacking on penalties and interests that are compounded daily, to your tax liability.

YOU MIGHT OWE THE IRS MONEY

Unfortunately, many taxpayers underestimate their tax liability during the year. That means they underpay and end up owing the government money. The IRS charges taxpayers a penalty for underpaying their taxes as well as interest on the amount of taxes that they owe.

Therefore, the sooner you file and pay any remaining taxes, the smaller your financial penalty and interest will be. If you can’t pay up front, you might have tax relief options.

IMPORTANT: We highly recommend readers to reach out to our firm first. Our clients never have to talk to the IRS, and tax resolution through our firm can save you money and time in the long run. You might also be eligible for other relief programs or get your penalties and interest forgiven. Reach out to our firm today for a consultation here or call 480-664-1249.

GET IT OVER WITH

There’s no better tax relief than just finally taking care of your taxes. If you are one of the many taxpayers that get stressed over taxes, you will actually feel better if you don’t procrastinate filing your tax return.

Just get it over with so it’s not hanging over your head! The peace of mind you get from not knowing where you stand with the IRS is worth it. It’s often not as bad as you think, even if you owe back taxes, having a firm like ours represent you can be worth it in the long run.

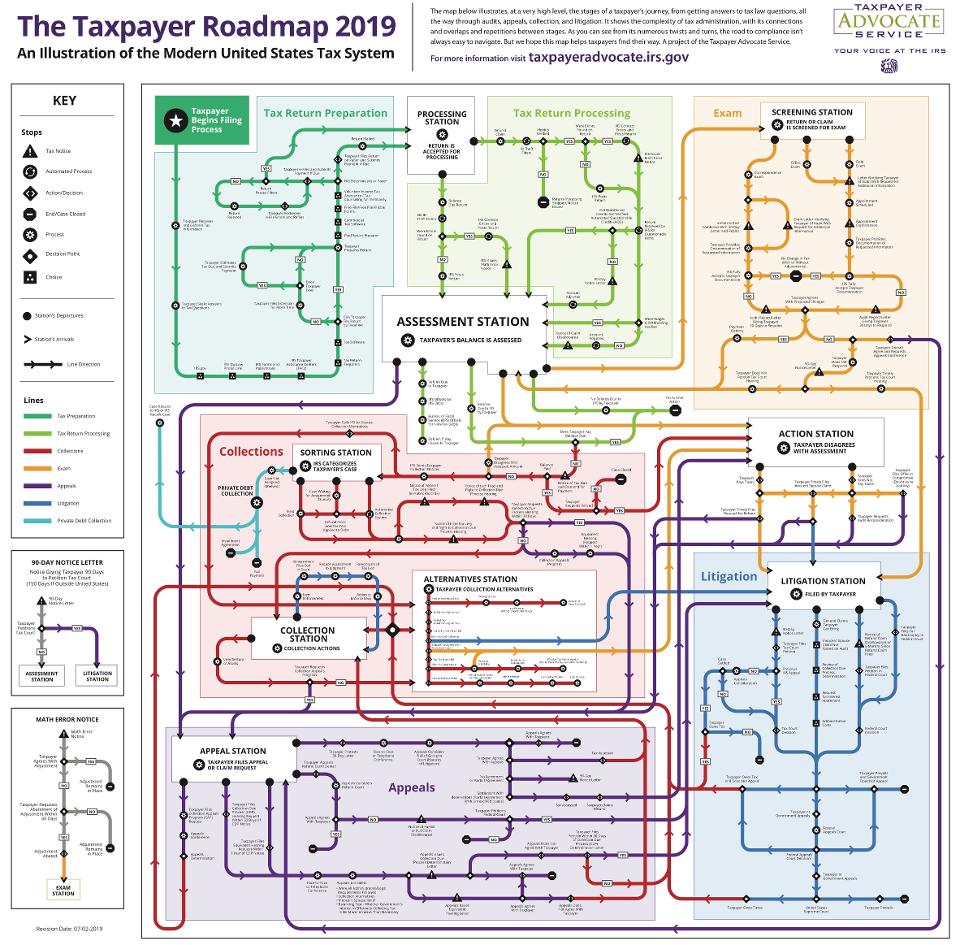

Our firm specializes in tax resolution. We serve clients virtually so don’t hesitate to reach out. If you want an expert tax resolution specialist who knows how to navigate the IRS maze, reach out to our firm and we’ll schedule a no-obligation confidential consultation to explain your options to permanently resolve your tax problem. Visit our webpage here or call our office at 480-664-1249.