Who Is Eligible For Covid Tax Relief?

At LBS Tax Services near Scottsdale, AZ, we understand the negative impact that the coronavirus has had on small businesses around the country. With nationwide lockdowns and stay-at-home orders, thousands of small business owners face newfound challenges. Thankfully, new acts and tax debt relief programs have been implemented to offer some relief to these struggling companies. Some of these new acts include the Coronavirus Aid, Relief, and Economic Security (CARES) Act, the Families First Coronavirus Response Act (FFCRA), and the Consolidated Appropriations Act (CAA). If your business has been affected by Covid-19, contact our team for a free, no-obligation consultation and learn how we can help you.

What Does The Payroll Tax Relief Program Cover?

Four programs are available to businesses: payroll tax deferral, employee retention credits, paid sick leave, and paid family leave. These programs are designed to help employers and employees during these complex and uncertain times. Our team is here to help you determine whether you qualify for one or more of these assistance programs.

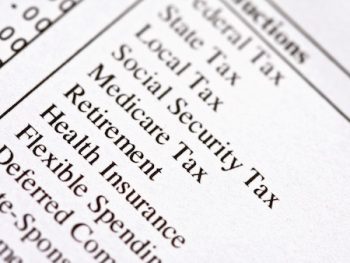

Payroll Tax Deferral

Under the CARES Act, employers can defer their share of employees’ social security tax for up to two years. Now, employers will pay 50% of their share in December 2021 and the other 50% in December 2022. This deferral does not apply to Medicare taxes or other withholdings.

Employee Retention Credits

Allows employers to get a credit on payroll taxes for specific wages and health plans while experiencing economic hardship due to COVID-19. There are two qualifications for financial hardship:

- If your business was fully or partially shut down due to governmental orders, including the stay-at-home order and the limitation of occupancy and business hours.

- If your gross receipts for a calendar quarter have been reduced to less than 50% compared to the previous year.

Paid Sick and Family Leave

If you have fewer than 500 employees, you are required to pay sick and family leave for any employees that need to miss work due to the need to quarantine, seek medical attention, care for someone that is quarantined or sick, or care for a child because their school or daycare is closed due to covid.

Get Professional Help With Your Small Business Tax Relief Today!

Small businesses have been a primary victim of the coronavirus pandemic, and now, more than ever, it is time to get help on your taxes and find relief anywhere possible.

Our team at LBS Tax Services is here to help eligible employers find additional tax credits they may need to include. Some of the tax credits that you may be eligible for include:

- Rent

- Ads and Marketing

- Office Supplies and Expenses

- Utilities

- Repairs

- Vehicles

- Travel Expenses

- Salaries and Employee Benefits

- Insurance

- And More

Whether your business has been negatively affected by COVID-19 or you want an expert’s opinion on business taxes, we’re here to help. At LBS Tax Services, helping small businesses is what we do best!

We Are Your Local Tax Relief Company Near Scottsdale

When you need help with your company’s taxes, trust the tax strategists at LBS Tax! Our team has decades of experience helping eligible employers manage their taxes. Not only can we help you navigate the new COVID-19 relief programs like employee retention credits, payroll tax deferrals on social security taxes, and paid family and sick leave, but we can also provide various other services. We provide payroll, bookkeeping, IRS debt forgiveness, and help with IRS payment plans. Contact the tax specialists at LBS Tax Services near Scottsdale, Arizona, today for a free, no-obligation consultation!